qocsuing's Blog

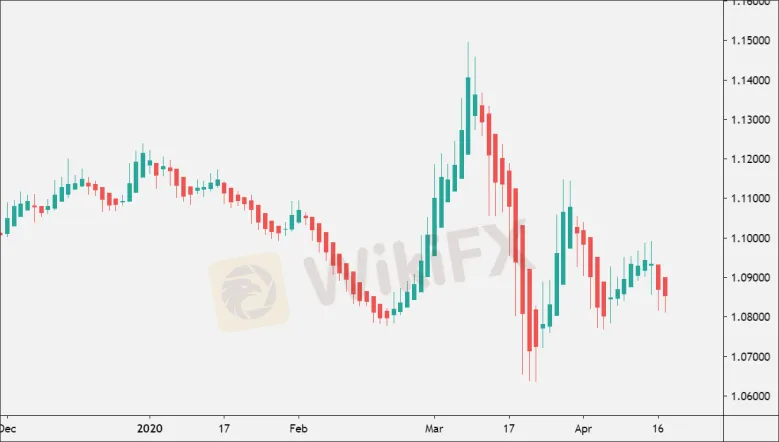

Expert Review of SurgeTrader

Expert Review of SurgeTrader

SurgeTrader is a classic prop company that allows traders to work with investors' money. The core of the proposal is as follows: are you confident in your abilities and your experience? Then you need to choose one of the company's course exam packages, get trained, and confirm your knowledge by passing the SurgeTrader Audition. Unlike other companies, SurgeTrader does not have a 30-day trial period. If you pass the test, within 24-48 hours you are assigned the appropriate status. This is one of the key advantages of the company.To get more news about surgetrader review, you can visit wikifx.com official website.

The second advantage of SurgeTrader is high trading commissions. The trader receives an account from USD 25,000 to $1 million under management, depending on the initially chosen package. And 75% of the profit is the trader's income. But to get it, the trader must adhere to fairly strict trading rules regarding the maximum daily loss and drawdown. Although the company is loyal to non-critical violations and can be flexible with the trader, for major violations it has a zero-tolerance policy, which includes the cancellation of the “SurgeTrader” status and the need to re-pay the cost of the course.

The first impression of SurgeTrader is positive. The terms of trade are formulated very clearly, and there are not many of them. The price of the courses is relatively high, but this is offset by the nonexistence of a test period, loyalty to random errors, and the opportunity to reach your full potential. There are no restrictions on the strategies used.

SurgeTrader is an investment company in and of itself, ready to invest in professional traders. SurgeTrader works with a venture investment fund that is ready to transfer money to the management of the traders who have proved their professionalism on a test account.

The prop trading model of SurgeTrader works as follows:

The trader pays for testing. The fee was introduced to eliminate beginners and traders without experience who are not ready for long-term cooperation. The amount depends on the chosen tariff plan. Tariff packages differ in the requirements for the target profit transferred to the management of the deposit.

Within a few minutes after the payment, the trader gets access to the account on the EightCap broker platform. The task is to earn money following the trading rules.

After passing the test mode, the trader gets access to a funded account. Its conditions are fully consistent with the conditions of the test mode. If a trader has paid for the exam package with access to USD 50K, in case of successful completion of the exam, he will receive a funded invoice for USD 50K.

There is a demo account for testing the trading platform. On it, you can go through test trading before paying for the exam. The trader's profit is 75% of the money earned. In case of major violations, the trader's account is disqualified, after which it is offered to pay for the exam with a 20% discount and take it again.

To obtain the status of an affiliate, you need to send an application by email, after which the company will provide access to the affiliate account. The account tools allow you to track affiliate statistics and the effectiveness of a marketing campaign. Remuneration payments are made at the beginning of each month.

ATFX Review 2023

ATFX Review 2023

ATFX is a Forex and CFD broker and is a part of AT Global Markets, an international investment holding company. The company is licensed by the FCA (UK), CySEC (Cyprus), FSC (Mauritius), and FSA (Saint Vincent and the Grenadines). The broker offers beneficial trading conditions for active traders as well as passive investors. ATFX service quality has been recognized by the many awards the broker has received, including Fastest Growing Forex Broker in Europe in 2017, and a 2018 Best Forex CFD Broker award from UK Forex Awards.To get more news about atfx review, you can visit wikifx.com official website.

The FCA and CySEC licenses are what attracted me to ATFX. I decided to try to work with the broker, but that didn’t work. The broker does not accept traders from Ukraine, so my application for opening an account was rejected after the registration. I managed to open an account only after I moved to Germany. I traded there for several months, but never earned a big profit.

The spread is too high on the standard accounts. In order to avoid paying sky-high commissions, you can deposit $5,000 on the account, but I’m not prepared to do that yet. I can say that this broker is suitable only for professionals, who have a large amount of free capital.

I read on one of the forums that ATFX was planning to launch a copy trading service. I decided to try it, but couldn’t find any information about it on the website. Customer support operators kept promising that the platform would soon become available. While I waited, I decided to open a demo account to test the service. The platform operates quickly, the deals are closed at the best price, but that is a demo account, so it’s understandable. I found a broker with better spreads, which is why I never opened a live account on ATFX.

Adrian Brooks,

ATFX customer support is rather unwelcoming. They don’t respond to the questions about the trading conditions and insist that you need to register. They promised to provide a personal manager once I opened an account, but why would I do that when I don’t really know their conditions? There is no information about PAMM and the copy trading platform on the website. Liquidity providers are concealed, the bonuses are available only to customers from five or six countries, and the commissions of the payment systems are not specified. After studying the website closely, I lost any desire to open an account here.

ATFX positions itself as a customer-oriented broker that is focused on the trader’s interests. Automation and flexible work are the key components of the successful operation of the company on the Forex market. ATFX provides technical and fundamental analysis, market forecasts, and trading rates from financial experts with vast experience of working both in the retail and institutional environment.

ATFX promptly reacts to the evolving needs of the customers and launches custom-made products to meet them. In particular, recently the company introduced ATFX Connect, a new division that was set up to service institutional professional customers. Also, in 2020, the broker introduced a proprietary social trading platform titled ATFX TeamUp.

The company updated the website, adding new useful sections – Trading Strategies and Market News. The information published in them will help beginners and professionals improve the quality of their trading skills.ATFX is a broker with conditions designed for active traders. The company also provides an opportunity to earn passive income without being personally involved in trading. The number of investment programs of ATFX is limited: the customers can invest in a PAMM account and earn a partnership reward under the Introducing Broker program. In 2020, the broker launched TeamUp, a proprietary social trading platform, which allows investors to copy trades of successful traders.

IS Golden Way RELIABLE?

IS Golden Way RELIABLE?

In this publication I will analyze Golden Way ¿Is the broker Golden Way (also known as goldenway.world) really trustworthy? Is it safe to invest your money with this company? I will examine this company in detail.To get more news about goldenway global review, you can visit wikifx.com official website.

Here are two things that I would like to highlight, (1) the first thing that is important to know is about its regulation and (2) the second is the location of the company. These are two data of vital importance to be able to measure the seriousness and reliability of a company.

Does the company have no regulation or is it regulated by an unserious country? Is the company located in an unreliable place or does it not mention where it is located? These are questions that every investor should ask about the reliability of the company.

When analyzing the Golden Way website, we can see that they offer educational resources, information on the different types of accounts, explanation of the products where the capital is invested, location of the company and means of contact.

1) If it makes me a little nervous that they do not mention anything about its regulation.

2) Another unfavorable point is the location: they do not mention where they are located, be very careful!

I have found various negative reviews, claims, complaints and negative feedback about Golden Way. I honestly think they are a very unsafe option. In addition to this, you can find more comments and opinions from users and customers of the company at the end of this review.

Are you a customer of Golden Way? Do you have something to tell me about them? I invite you to leave your opinion too!

If you have been scammed, then I explain, in my opinion, one of the most effective methods to recover capital. If you do it on time and with a serious company, it is highly effective.

We work with a capital recovery service. here you can claim your money.

In a few words, we use the chargeback method or capital withdrawal, with this method what we do is ask the bank or Visa, or Mastercard (depending on how we send the money), to return our capital, since we have been scammed. In order to recover it, we have to prove that we have indeed been scammed.

TD Markets Broker Review

TD Markets Broker Review

Since 2015, TD Markets has been a leading forex and CFD broker. Its simplicity is the underlying principle of the company. Creating an account is quick, and the trading platform is the popular MT4 used by many traders today.To get more news about td markets review, you can visit wikifx.com official website.

Our recommendation is to read this broker’s entire review to understand better the features and tools it offers.Based in Sandton, Johannesburg, this broker platform operates in numerous African countries and is regulated by the Financial Sector Conduct Authority (FSCA) under FSP number 49128. The Metatrader 4 platform is award-winning, and withdrawals are available 24 hours a day.

Retail traders and institutional traders alike work with them around the world. Through the constant adaptation of its product offering, they drive innovation in the financial markets.

The broker ranks among the top single stock instrument basket brokers globally after adding single stock CFD instruments and ETF CFDs.

It operates according to its core values to achieve transparency and diversity. As a Financial Services Provider with the Financial Sector Conduct Authority, this platform offers attractive, purely STP trading conditions worldwide. In South Africa, it operates under TD Markets (Pty) Ltd.St. Vincent and the Grenadines Financial Services Authority (SVGFSA) and the Financial Services Compensation Authority (FSCA) regulate the broker.

Despite being registered in the UK, the company does not have FCA authorisation. The company is an STP/NDD; although it claims to offer DMA execution, its trading conditions are attractive.

Trading with this platform gives traders peace of mind. The company employs a variety of protocols designed to ensure their funds and clients’ equity is protected to the fullest extent possible.

It is a registered Financial Services Provider with the Financial Sector Conduct Authority; TD Markets operate as TD Markets (Pty) Ltd South Africa in South Africa.

Through world-class product offerings, a unique service model, ongoing support, and education, the broker claims to be capable of serving retail, institutional, and professional clients with unmatched expertise.You will not be charged a deposit fee or an inactivity fee. Financial institutions may waive additional charges for traders.

In addition, traders may be charged no conversion fees if they transfer fees in a currency other than their account base currency. They charge no withdrawal fees.

Traders need to remember that though the brokerages may offer them high leverage, trading at such a high level is only suitable for experienced traders who can prevent significant losses.

Leverage amounts are expressed as a ratio of 50:1, 100:1, or 500:1. In the case of trading ticket sizes of 500,000 USD/JPY and $1,000 in your trading account, your leverage equals 500:1.

The margin is used to cover any credit risks that may arise during the trading process. To ensure sufficient margin, you must have funds in your trading account equal to the percentage of your positions (e.g., 5% or 1%).Trading the mini account on the MetaTrader 4 platform is possible with a basic forex trading account, offering variable spreads and leverage up to 1:500.

Minimum initial deposits are low, high leverage is possible, and variable spreads and commissions are relatively low. Scalping, hedging, and copy trading are allowed.

Muslim traders following Sharia law have the option to open an Islamic Account with this platform upon request.The software used to execute its clients’ trades is its forex trading platform. Brokers usually offer one platform or several at the same time.

Clients who trade forex can also trade other asset classes on a multi-asset trading platform. A client’s decision about which platform to use typically depends on what they want to trade.

As one of the most popular trading platforms, MetaTrader 4 (MT4) is provided by TD Markets. Its simplicity and various useful features make it popular.

Therefore, traders can conduct transactions and analyse the market dynamics, automate their trades through a variety of Expert Advisors, and back-test their strategies.

Aputure Takes on Philips Hue and Nanoleaf with amaran RGB LED Strips

Aputure Takes on Philips Hue and Nanoleaf with amaran RGB LED Strips

amaran, which is always lower-cased, is an offshoot brand of Aputure — a company that has for years produced a variety of lighting products for photographers and filmmakers — and the new Bluetooth and WiFi-controlled SM5c are its first-ever RGB smart pixel LED strip lights that the company says are for content creators who not only want to light large spaces, but also want to “create an environment for fostering creativity and innovation.”To get more news about led neon strip light, you can visit htj-led.com official website.

In short, they’re lights designed to add ambiance to a personal or workspace and also would work for those who want to add background lighting effects to live streams. That angle leans pretty heavily into a space that is currently dominated by the likes of Philips Hue and Nanoleaf, but Aputure amaran says it has put some unique features into the light strips that make them stand out.

The SM5c is a five-meter long (about 16.4 feet) LED strip. The “SM” in the name stands for smart, the “5” refers to the length, and the “c” references its color capabilities. The strip features 300 RGB LEDs and 100 pixels, which Aputure says can be customized with different designs and lighting effects using the Sidus Link app.

The company says the SM5c is the first RGB product instead of RGBWW and Aputure says its “advanced circuitry” allows it to simultaneously display more than one color and have pixel control capabilities. The 100 pixels can be independently controlled over five or 25 light zones, and the strip comes with 21 built-in pixel effects out of the box.

The whole strip includes a frosted diffusion layer over the lights which Aputure says creates a soft glow and reduces glare, making it better for direct viewing and for use on camera.

“The SM5c is mainly designed to be an effects light to create saturated colors, pixels, and effects. It is not designed to be used as a key light, fill light, on skin tones, or to create a white light effect, which existing Aputure and amaran lights that utilize the RGBWW chipset with white light reproduction are designed for,” the company says.The SM5c also is the first Aputure light that has a built-in microphone in its external controller. It allows the lights to react to music and while existing Aputure and amaran products can create music effects by uploading audio clips via Sidus Links, the SM5c is the first product that can enable this feature natively via the external controller. The lights are also compatible with Google Assistant and Amazon Alexa.

The strip can be extended by an additional five meters with an optional SM5c Extension for a total of 10 meters of LED light without the need for an additional power supply. The two strip lights are connected via an 8cm header feeder cable which allows users to create one continuous light effect.

2023 Door And Window Sensors

2023 Door And Window Sensors

“Door And Window Sensors Market” research providing information to drive merges and acquisition strategies to expand market Share, 2023-2027. Report also providing business strategy with different parameters like trend, future challenges, industry players, with regional segmentations with. This report aims to provide a comprehensive presentation of the global market for Door And Window Sensors Market, with both quantitative and qualitative analysis, to help readers develop business growth strategies, assess the market competitive situation, analyse their position in the current marketplace, and make informed business decisions regarding Door And Window Sensors Market.To get more news about door and window sensors, you can visit securamsys.com official website.

In this section, the readers will gain an understanding of the competing key players. This report has studied the key growth strategies, such as trends, intensification of product portfolio, mergers and acquisitions, collaborations, new product revolution, and geographical expansion, undertaken by these participants to maintain their presence. Apart from business strategies, the study includes current developments and key financials. The readers will also get access to the data related to global profit, price, and sales by manufacturers for the period 2017-2023. This all-inclusive report will certainly serve the clients to stay updated about current status and make effective decisions in their businesses. Some of the remarkable players reviewed in the research report include:

This report has explored the key segments: by Type and Application. The lucrativeness and growth potential have been looked into by the industry experts in this report. This report also provides sales, revenue and average price with forecast data by type and application segments based on production, price, and value for the period 2027.

Global markets are presented by Door And Window Sensors type, along with growth forecasts through 2027. Estimates on production and value are based on the price in the supply chain at which the Door And Window Sensors are procured by the manufacturers.

This report has studied every segment and provided the market size using historical data. They have also talked about the growth opportunities that the segment may pose in the future. This study bestows production and revenue data by type, and during the historical period and forecast period (2023-2027).This report has provided the market size (production and revenue data) by application, during the historical period and forecast period (2023-2027).

This report also outlines the market trends of each segment and consumer behaviours impacting the Door And Window Sensors market and what implications these may have on the industry's future. This report can help to understand the relevant market and consumer trends that are driving the Door And Window Sensors market.

Digitally create 2D drawings and 3D models of real-world products

Digitally create 2D drawings and 3D models of real-world products

Regardless of your challenge in mechanical and electromechanical development, we offer a complete suite of CAD/CAM/CAE products. The efficient design and optimization of sophisticated products is a constant challenge and products are about to get even more complex. To stay competitive in today’s market, organizations need advanced and effective development solutions.To get more news about cad software company, you can visit shine news official website.

![]()

Computer-aided design is a way to digitally create 2D drawings and 3D models of real-world products—before they’re ever manufactured. With 3D CAD, you can share, review, simulate, and modify designs easily, opening doors to innovative and differentiated products that get to market fast.

PTC Creo has been on the cutting edge of computer-aided design for more than 30 years with the most scalable range of 3D CAD product solutions in today’s market.

Creo gives you the power to manage, visualize, and design smarter utilizing visualized flexibility, Generative Topology Optimization, additive manufacturing, generative design, IoT, MBD and augmented reality (AR).

Onshape is a revolutionary new CAD technology that is only available as a pure Cloud SaaS solution . Onshape has no files, Onshape works purely database based. Collaboration and PDM is part of Onshape. The first CAD system that enables true simultaneous engineering. No system crashes, no implementation effort, no updates… Onshape is up and running in minutes . And that’s not a promise, it’s a fact.

How service robots make sense of their surroundings

How service robots make sense of their surroundings

Service robots play an increasingly vital role in society, from transportation and warehouse logistics to home entertainment and security. Regardless of their application, they need to sense changes in their surroundings in real-time to ensure safety while providing a positive user experience. To illustrate how various sensor technologies from TDK’s SmartSensor family can be applied in service robots, this article focuses on a robotic vacuum cleaner (RVC).To get more news about GRS, you can visit glprobotics.com official website.

Early versions of robotic vacuums had very little intelligence, randomly bumping their way around the home and sometimes missing areas as they did not know where they had been. Often, they would unwittingly become trapped or run out of charge mid-sweep. And, as their dust box is comparatively small to a regular vacuum cleaner, if full, they could be sweeping but not collecting anything up. Over the years, with the innovative use of sensors and motor controllers, vacuum cleaning robots have become much smarter, overcoming these issues.

Fundamental to any RVC is its ability to move around with a high degree of accuracy. Here, TDK’s intelligent HVC 4222F embedded motor controllers provide direct control of various stepper motors, and brushed (BDC) and brushless (BLDC) DC motors. They drive the motors that turn the gears to ensure the wheels are moving the RVC in the right direction. The high accuracy of these devices is of vital importance to ensure that the cleaner does not go off-track, whether you use sensors or not; knowing that the wheel is turning 90-degrees as opposed to 88-degrees is essential to ensure the RVC is where it thinks it is over a certain amount of time.

Ultrasonic time-of-flight (ToF) sensors, such as the CH101 and CH201, provide accurate range measurements to targets at distances up to 1.2m and 5m, respectively. They send out an ultrasonic pulse and then listen for echoes bouncing off objects in the sensor’s field of view (FoV). The built-in processing unit calculates the ToF and the external control unit determines the distance to the objects. Unlike optical distance sensors, ultrasonic sensors work in any lighting condition, including the dark, and provide millimeter-accurate measurements independent of the target’s color and can detect transparent objects such as glass.

In the robotic vacuum cleaner, the long-range CH201 can be used to detect both moving and stationary objects day and night, deviating its route well in advance to avoid a collision. The shorter range CH101 ultrasonic ToF sensor can be implemented into the robotic vacuum cleaner to determine different floor types. Here, the amplitude of the reflected signal differs if the target surface is either hard or soft. When the robotic vacuum cleaner moves from wooden flooring to a carpeted area, the sensor can instruct the motors to speed up as they need to work harder on this flooring type. These sensors can also detect whether the cleaner is at the top of a set of stairs, averting a fall.

Easy Forex Review 2023

Easy Forex Review 2023

When first setting up an account with easy-forex, traders can define the type of account they wish to use according to the level of risk they are willing to take. A Standard account comes with a margin of as little as $25.To get more news about easy forex review, you can visit wikifx.com official website.

Additional account types are Premium and VIP. The type of the account will also determine the spread offered to the client, ranging from 3 pips for a standard account, 2.5 pips for Premium and 1.8 pips for VIP.

Demo accounts are available and traders can trade on mobile, desktop or online. There are free personal trainers, guaranteed stop-loss and other features similar to a real account.

easy-forex also offers trading accounts which adhere to the Islamic law (Sharia). With Islamic trading accounts, when traders extend their Day-Trading deals to the next day, no rolling fee is charged. Accordingly, the maximum duration offered for Day-Trading deals is limited (usually 1 week but it can also be shorter or longer depending on the currency pair traded).

Traders can select over 175 products ranging from currencies, commodities and metals, to options, using their desktops, tablets or smartphone devices with account. easy-forex offers a wide range of Energy Commodities including WTI Crude Oil, Brent, Natural Gas, Heating oil and Gasoil. There are also several energy commodity pairs such as HEO / USD, OIL / USD and others.

There is also a wide range of agricultural commodities over and above what most brokers offer such as cocoa, corn and coffee.

Traders can take advantage of the easy-forex Trade Simulator with no obligation or risk and at no cost. The Trade Simulator lets newbie traders explore the easy-forex platform features which include the Inside Viewer that shows them the most popularly traded currency pairs or the Trade Controller that enables them to visually set their risk management strategy.

easy-forex provides traders with a host of educational tools. There are training videos for both beginners and advanced traders and a free Forex guide ebook that can be easily downloaded and includes basic information on trading in general as well as tips and techniques for successful Forex trading.

Forex webinars are online and accessible from anywhere in the world and seminars offer traders an opportunity to meet the easy-forex team in person and interact with traders like themselves from other areas. An additional chance to meet other traders is provided at easy-forex expos which take place periodically in many different locations. A listing of upcoming expos and other events are listed on the website.

In the ‘Further Reading’ section, members can choose from a variety of different articles on various areas of Forex trading.There were several promotions going when doing this review. A 20% bonus up to $2000 was offered on a trader’s first deposit.

With the Win-Win bonus, a trader need only make a deposit of any amount. If the trade comes in as a profit, easy-forex doubles the win; if it’s a loss, the broker will cover it up to $200.

easy-forex makes option trading easy by offering $300 in risk-free trading to anyone opening an account.

Should a trader decide to become an affiliate or introducing broker with easy-forex, he/she can receive up to $600 (for online affiliates) and up to $100 lot rebate (for introducing brokers). All partners earn 10% commissions from their sub-affiliates.

There is also a Refer-a-Friend promotion where the referrer receives from $50-$500 on deposits of $200 to $5,000. The friend receives 50% of the reward.

TradeStation Review 2023

TradeStation Review 2023

Professional trading experience: TradeStation is a top-notch choice for serious investors seeking a truly professional-level trading experience. In fact, at one time TradeStation catered solely to professional brokers and money managers. Now, regular investors have access to the firm’s high-octane tools, especially after the company cut trading costs and account minimums to $0.To get more news about tradefills review, you can visit wikifx.com official website.

Variety of investment selections and tools: In addition to stocks, bonds, funds and options, TradeStation offers futures and cryptocurrency trading. Its desktop and mobile trading platforms come with a wide range of built-in tools, including charts, news and data feeds.

Add-on fees: Access to many of TradeStation's features requires an additional financial outlay or subscription for those who do not meet certain account or trading minimums. TradeStation also charges an annual inactivity fee of $50 for accounts that don't maintain certain balance or trade minimums.

TradeStation charges $125 for outgoing account transfers; for IRAs, TradeStation charges a $35 annual account fee and a $50 IRA account termination fee. TradeStation also charges an annual inactivity fee of $50 for accounts that don't maintain an average end-of-month equity balance of $2,000 or execute at least five trades during the 12-month period following the anniversary of when the account was first funded.

Number of no-transaction-fee mutual funds: 1 out of 5 stars

TradeStation does not offer no-transaction-fee funds, and fund research is also thin. However, the $14.95 mutual fund commission is in line with other mainstream brokers.

Tradable securities available: 5 out of 5 stars

TradeStation allows users to trade stocks, bonds, mutual funds, exchange-traded funds, options and futures, as well as some select cryptocurrencies. Forex traders, however, need to look elsewhere.

Crypto offering: 5 out of 5 stars

Through its affiliate, TradeStation Crypto, users can buy, sell and trade 11 different cryptocurrencies directly using cash. If you already own some crypto, there are also a number of cryptocurrency pairings offered on the platform. If you’re looking to exchange one crypto for another, you’ll want to check TradeStation’s website to make sure your transaction is supported by the platform.

TradeStation uses a volume-tiered maker/taker fee structure, meaning that the transaction fee might be higher or lower depending on how large each transaction is, and whether the order can be immediately filled. For instance, transactions under $1,000 will carry a $2 flat fee, plus an additional 0.35% maker fee (if the order can't be immediately filled) or a 0.6% taker fee (if the order can be immediately filled). Transactions over $1,000 do not carry the flat $2 fee.

Users also have the option to use personal crypto wallets to take their crypto off the platform, giving it a boost on our roundup of the best crypto exchanges and platforms, which compares TradeStation against pure-play crypto brokers such as Gemini and Coinbase.

Trading platform: 5 out of 5 stars

TradeStation is best known for its impressive desktop platform. It offers direct-market access, automatic trade execution and tools for customers to design, test, monitor and automate their custom trading strategies for stocks, options and futures. Users can customize their desktop, using a broad palette of colors to better highlight the most relevant data. Investors can test-drive new strategies in real time before putting actual money on the line with the TradeStation Simulator.

Options investors will appreciate free access to the OptionStation Pro platform. With its preview mode, mobile-app users can create custom watch lists, and view charts and trends without opening an account.

Traders who are not brokerage clients can subscribe to use TradeStation tools: Non-professional traders pay $99 per month, while professional traders are charged $199 per month.

For access to advanced, comprehensive research, TradeStation earns decent marks. Hundreds of indicators are included with the TradeStation 10 platform (and many more can be downloaded or created using its EasyLanguage coding feature). Investors can back-test strategies using historical market data that includes more than 90 years of daily data and decades of intraday data. Notifications alert users to upcoming earnings announcements or important market moves based on their positions.

TradeStation has a respectable assortment of free data and analytical tools, with dozens of charting tools, a news feed from Benzinga and market data feeds from most of the major exchanges.